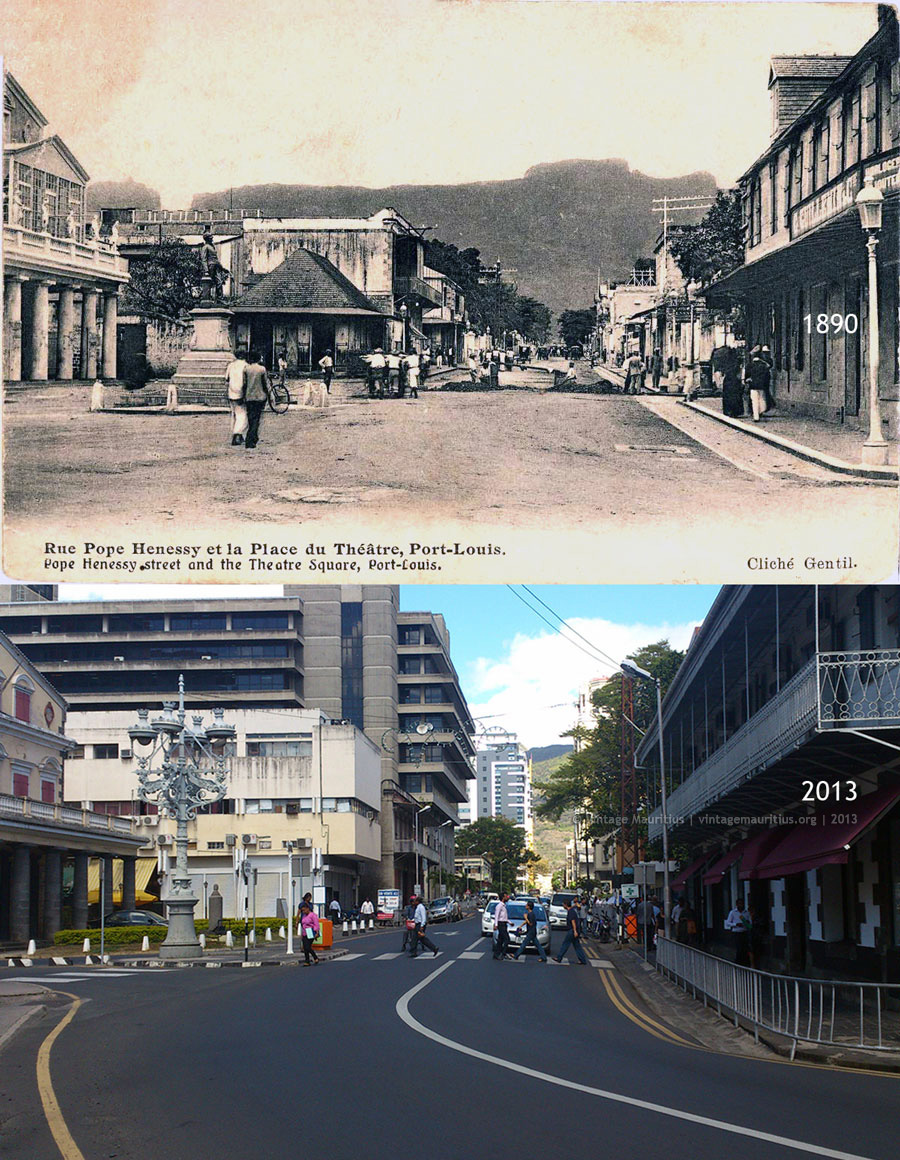

Mauritius Now & then

While historical records indicate that the Arabs and Portuguese knew the island, but the Dutch were officially the first settlers. They arrived in 1598 establishing a settlement of the Dutch East India Company, named the island Mauritius after their prince Maurits Van Nassau and eventually left in 1710. The island was in the limelight and quite sought after during the glory years of the spice trade when ships left Europe and contoured the Cap of Good hope in Africa to trade spices with India and the Asian subcontinent. The French claimed the island in 1715 and renamed it, Isle de France. The French and British empires frequently battled each other to govern the island. In 1810 the British launched an attack from the sea and conquered the island. It remained a dominion of British Empire until 1968 when Mauritius acquired independence from Great Britain.

Following independence, the economy was successfully manoeuvred towards diversification moving away from a sugarcane based economy. Later the tourism sector was launched followed by the manufacturing sector through special tax free incentives to attract investors and foster the transfer of technology in the 1980’s, and more recently the service sector.

Today, the island is lauded as one of the most thriving economies in Africa. The country was ranked 1st in Africa and 32nd out of 189 countries by the World Bank’s ease of doing business rating for the year 2016. Being a small island developing state, Mauritius has much ground to cover and it is a country with stable institutions geared to achieve progress.

Trading in financial products usually involves a risk element. As a general rule, prior to trading in any financial product the client should understand the products and the underlying risks associated with them.

Please be advised that while we endeavour to assist our clients in their best possible interest, we all remain economic agents of the global economy whereby the market regulates itself. This market regulation mechanism remains independent and unpredictable, it may play in favour of clients and their respective positions, or against them. These risks remain similar for all organizations functioning within the sphere of open and market regulated economies.

Copyright © 2017 Croesus Treasury Management Ltd . All Rights Reserved.